The Korean art market has experienced unprecedented and dramatic growth in recent years. Although this growth is related to and mirrors the rise of the global art market, the rise of the Korean art market can also be attributed to economic and social factors unique to Korea.

The Rise of the Korean Art Market

The rise of the Korean art market is evident in the turnover of the two leading auction houses in Korea, Seoul Auction and K-Auction. Seoul Auction, established in 1998 by Gana Art – one of Korea’s most prominent commercial galleries, reported a turnover of $96.3m in 2007, nearly three times its turnover in 2006. Its direct competitor K-Auction, launched in November 2005 by Hyundai Gallery, another leading gallery in Korea, has shown similar remarkable growth, reporting a turnover of $61.6m in 2007. This astonishing growth of the Korean art auction market can be seen in Figure 1.

Furthermore, according to the trend report released by Seoul Auction, the prices for modern and contemporary paintings rose by 51.9% on average from 2006 to 2007. 2007 also witnessed 10 price records for artworks sold at auction. The most expensive piece sold was Park Soo Keun’s oil painting titled A Wash Place which fetched $4.5m at Seoul Auction in May 2007, replacing the previous $2.5m record for Ladies of a Marketplace achieved by the same auction house just two months earlier.

This sudden and explosive growth of the Korean art market is attributable in a large way to circumstantial changes in the domestic investment market. Most notably, the phenomenon coincided with the recent last-gasp efforts by the Korean government to deflate property speculation. New anti-speculative measures, imposing stringent transfer income taxes and other restrictions on real estate deals, had frozen the property market in Seoul, especially in the wealthy neighborhood of southern Seoul where apartment prices had doubled in the last five years. The low interest rate and volatile stock market also cast doubt on more traditional forms of investment, leading investors to search for alternative assets to park their wealth. This led to the rise of investment in art. Another contributing factor is the favorable Korean tax system, which does not impose capital gain taxes on personal transfers of artworks as well as on inheritances or gifts to heirs. As a result, investment in art has quickly caught on as a new form of tax avoidance among the rich, in the process attracting speculators who do not have intrinsic interests in art but see it purely as an investment tool.

This speculative frenzy has also been fueled by intense media coverage. As real-time information is made available by the Internet, media headlines about the high profits made in the art investment worldwide also became prevalent in Korea. Added to this has been constant news coverage about emerging Korean artists who are achieving record-breaking sales at international auctions such as Christie’s in Hong Kong and Sotheby’s in New York. Within Korea, the competition between Seoul Auction and K-Auction have also attracted media attention, with newspapers and web-based media reporting new sales records and the market explosion. Although the increased interest of the media has been, in some senses, the catalyst for the speculative frenzy, it has, on the other hand, attracted a new generation of perceptive collectors capable of making informed purchases.

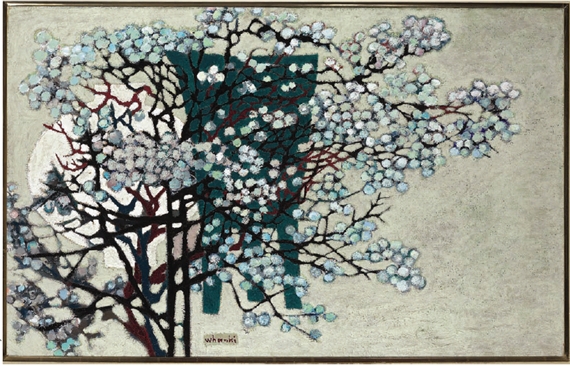

Within this environment, the modern and contemporary art categories have proved the most speculative. According to the Top 10 Auction Artists list compiled by Seoul Auction, the sales of so-called ‘super blue-chip’ artists such as Lee Ufan, Park Soo Keun, Kim Whan-ki and Kim Jong Hak exceeded $100m, accounting for more than 60% of total auction sales in 2007. The prices for top artists also rose by 49.1% on average. What brought about the sudden price inflation has been the reappearance of major works that were sold during the market boom of the 1980s and early 1990s, coupled with the short supply of quality works in the market. However, with the exception of Lee Ufan, the majority of these artists have only been traded within Korea, and as such, the prices achieved at local auction cannot be compared to international price levels. It further suggests that, in spite of the history and maturity of the primary market sector, the Korean art market still remains highly local.

ARTISTS

ARTISTS